Possible Medical Expenses

*Listing of Possible Medical Expenses These can be deducted from your gross income to determine VA benefit eligibility. *

- Medicare Premiums deducted from Social Security

- Supplementary medical insurance (Part B) under Medicare

- Abdominal supports

- Acupuncture service

- Ambulance hire

- Anesthetist

- Arch supports

- Artificial limbs

- Back supports

- Braces

- Cardiographs

- Chiropodist

- Chiropractor

- Convalescent home (for medical treatment only)

- Crutches

- Dental services Dentures

- Dermatologist

- Eyeglasses

- Food or beverages prescribed by doctor for treatment of illness

- Gynecologist

- Hearing aids & batteries

- Home health services

- Hospital expenses

- Insulin Treatment

- Insurance premiums (medical)

- Invalid chair

- Lab tests

- Lip reading lessons (in connection with disability)

- Neurologist

- Nursing services

- Occupational therapist

- Ophthalmologist

- Optician

- Optometrist

- Oral surgery

- Osteopath

- Pediatrician

- Physical examinations

- Physician

- Physical Therapy

- Podiatrist

- Prescriptions and drugs

- Psychiatrist

- Psychoanalyst

- Psychologist

- Psychotherapy

- Radium therapy

- Sacroiliac belt

- Seeing-eye dog

- Speech therapist

- Splints

- Surgeon

- Telephone/teletype for deaf

- Transportation expenses (20 cents per mile)

- Vaccines

- Vitamins prescribed by doctor

- Wheelchairs

- Whirlpool baths for medical purposes

- X rays

Note: Most medical expenses must be prescribed by a physician to be deductible from gross income for VA benefit qualification purposes.

Contact us regarding these decisions. We will analyze your specific situation and provide guidance in these matters.

Contact us now and someone in our office will respond the following business day.

From the blog

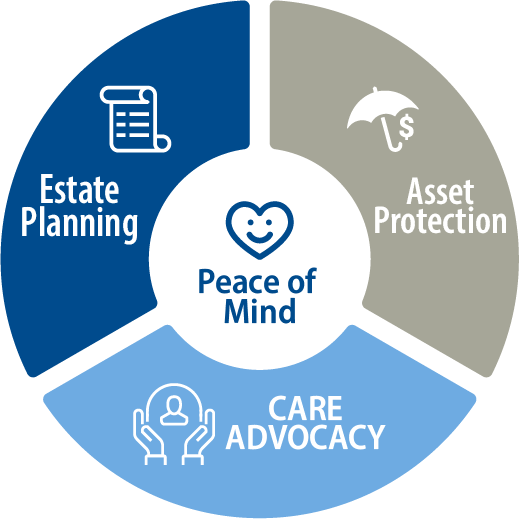

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind