Dealing with the death of a loved one is a traumatic experience that we will all face at some point in our lives. The prospect of dealing with insurance companies, government agencies and the local courts can be overwhelming during this painful time. Our goal is to minimize the stress family members face by efficiently and effectively guiding them through this complex process. Whether there is a valid will in place or your loved one dies intestate (without a will), we will work hand-in-hand to properly guide you through the process.

What is a personal Representative?

In the state of Georgia, when someone passes away and their estate is still in their name, the probate court in the county where they resided requires that a personal representative (PR) be named and their property goes through a process called “probate” or “administration.” This is a legal hoop that the family must go through before passing the property on to the beneficiaries of a Will or heirs-at-law when there is no Will. A PR is often called an Executor when there is a will and an Administrator when there is not a will

The PR or executor(s) of the Will file a Petition to Probate the Will and attaches the original of the Will and a copy of the death certificate. This Petition is filed in the county where the deceased person resided. The executor is then required to take an oath of office swearing to distribute the property according to the terms of the will. Once the oath is taken, the executor is issued Letters Testamentary, which allow him/her to act on behalf of the estate.

In Georgia when a person dies without a valid Will, they are said to have died “intestate”. That means that the Georgia rules of inheritance determine how the deceased’s assets will be passed to their heirs-at-law. If there are assets, the administrator(s) of the estate (usually a family member) files a Petition for Letters of Administration along with a copy of the death certificate in order to become the PR. This petition is filed in the county where the deceased resided. The administrator is also required to take an oath of office swearing to administer the estate in accordance with Georgia intestacy laws. The administrator is then issued Letters of Administration allowing him/her to act on behalf of the estate. The administrator’s job is to make sure the deceased’s assets get distributed according to Georgia’s rules of inheritance.

What are the responsibilities of the personal Representative?

Once the PR receives Letters Testamentary (valid Will) or Letters of Administration (no valid Will), the probate assets are collected and put in the name of the estate. The PR has six months after appointment in which to determine the condition of the estate. The PR must publish a notice to creditors within 60 days of taking office. The creditors are paid in a specific order determined by the state legislature. The bad news is that if the assets run out before the debts are paid, those creditors lower on the list are not paid and no one receives an inheritance. The good news is that no one else, including the PR, is responsible for the remaining debts.

In the course of administering the estate, the PR may need to sell property, either to be able to pay the debts and expenses or to better be able to distribute the estate among the beneficiaries. Also, the PR is responsible for filing certain tax returns. The deceased’s final tax return is due by April 15th in the year following the year of death. In addition to the tax returns for the deceased, the PR may be required to file income tax returns for the estate. A federal tax identification number from the IRS may be required for accounts opened by the PR in the name of the estate at financial institutions. This number will also be used on the tax returns filed by the PR for the estate.

When is Probate over?

After the PR settles all claims, expenses and taxes, the remaining assets are distributed to the heirs. The PR may be required to file certain reports with the probate court in which the PR was appointed. Every PR should keep complete and accurate records of all dealings in the administration of the estate until the PR is discharged. When probate is finished a Petition for Discharge should be file closing the Estate. Once the court is satisfied that the administration was proper and that the PR has faithfully performed the duties required, the court issues an order discharging the PR from office and any further liability.

Georgia Rules of Inheritance

- If you are married without children, your spouse will inherit your entire estate.

- If you are married with children, your spouse and children will share your estate equally with the spouse entitled to no less than 1/3 of your estate. So, if you have one child with your spouse, they each will receive __y percent (50%) of your estate. If you have four children and a spouse, your spouse will receive 1/3 of your estate and the four children will share equally the remaining 2/3.

- If you are not married but have children, the children will inherit your estate, shared equally among them. Please note that if a child of yours is deceased but has living children, those living children will inherit your deceased child’s share. This is called distribution “per stirpes.”

- If you do not have a spouse and do not have children, then your parents will inherit.

- If you do not have a spouse and do not have children and your parents are deceased, then your siblings will share your estate equally, per stirpes.

- Assuming the facts in E above, but you have no siblings, then your grandparents will share your estate equally.

- If your grandparents are deceased, then your uncles and aunts will be entitled to your estate.

- If no relatives can be found to inherit your property, it will go into your state’s coffers.

Dying Without a Will can Cause Big Problems

Dying without a Will can cause your family unnecessary stress and grief. Learn how Georgia decides how your estate is distributed if you die without a Will

For assistance with questions about the Probate process in Georgia

Contact us now and someone in our office will respond the following business day.

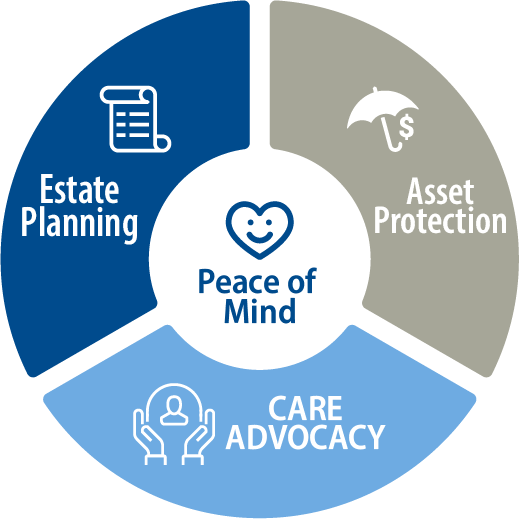

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind