Qualifying for the VA Aid and Attendance benefit can be challenging. This is especially true since major the changes to the Aid and Attendance benefit that went into effect on October 18, 2018.

Basic eligibility rules include an array of service, income, and asset requirements that must be met before the benefit can be awarded. The Aid and Attendance benefit also requires a qualifying veteran or their surviving spouse to be paying for long-term care expenses that are unreimbursed by health insurance, medicare or long-term care insurance.

These hurdles can seem daunting to families who need extra income to pay for care and have been told they have too much money to qualify. The Certified Elder Law Attorneys at Hurley Elder Care Law can devise a strategy to allow veterans or a surviving spouse to qualify for the benefit.

The Basics

There are now over 25 million US veterans eligible for of VA benefits. Most believe they are only entitled to benefits if they were actually wounded or disabled while they were serving in the armed forces.

Few vets realize that VA special pensions exist, including the Aid and Attendance Pension (and their local VA office won’t tell them about it!). Many vets are battling chronic conditions and struggling to pay for their care.

VA special pensions are just one tool that we can look to when helping people plan for their long-term care needs. We can help you understand what the options are and how to access underutilized benefits available to veterans and their or surviving spouses.

We take a comprehensive, hands-on approach to planning for Veterans and their spouses.

Our goal is not only to obtain the benefits a veteran may be entitled to but also to protect the assets of the veteran and spouse. We work to preserve the resources the veteran and spouse need to ensure their complex and evolving care needs are met throughout their lives. We provide a detailed asset plan that not only makes obtaining benefits possible but also protects eligibility for other benefits they may need in the future such as Medicaid.

Eligibility Requirements

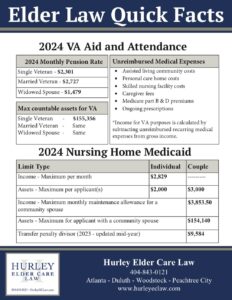

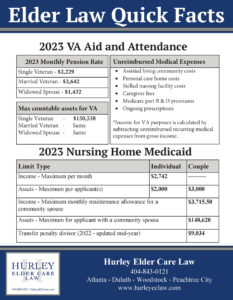

In 2024 a single veteran is eligible for a maximum of $2,301 per month.

A single veteran can have no more that $155,356 in total assets (as of January 1, 2024). This amount includes retirement assets but excludes a home and a vehicle.

There is NO specified income limit for VA pension benefits. The VA has it’s own definition of income which they utilize in examining an application. Your income for “VA Purposes” is your gross income less your unreimbursed medical expenses.

The VA has instituted a 36-month look back period for assets. This means that if you have given away any assets in the 36 months prior to applying for VA benefits, you may incur a penalty period or be disqualified for VA benefits. Consulting with a Certified Elder Law Attorney can help you determine the best way to qualify given your circumstances, and the quicker you act, the more options you will have.

Click here to contact us regarding Veteran’s Benefits. We will look at your specific situation and find ways that we may be able to help!

In 2024 a married veteran is eligible for a maximum of $2,727 per month.

A married veteran can have no more that $155,356 in total assets (as of January 1, 2024). This amount includes retirement assets but excludes a home and a vehicle.

There is NO specified income limit for VA pension benefits. The VA has it’s own definition of income which they utilize in examining an application. Your income for “VA Purposes” is your gross income less your unreimbursed medical expenses.

The VA has instituted a 36-month look back period for assets. This means that if you have given away any assets in the 36 months prior to applying for VA benefits, you may incur a penalty period or be disqualified for VA benefits. Consulting with a Certified Elder Law Attorney can help you determine the best way to qualify given your circumstances, and the quicker you act, the more options you will have.

Click here to contact us regarding Veteran’s Benefits. We will look at your specific situation and find ways that we may be able to help!

Click here for a list of possible medical expenses.

Click here for eligible dates of service.

In 2024 the surviving spouse of a veteran is eligible for a maximum of $1,479 per month.

A single veteran can have no more that $155,356 in total assets (as of January 1, 2024). This amount includes retirement assets but excludes a home and a vehicle.

There is NO specified income limit for VA pension benefits. The VA has it’s own definition of income which they utilize in examining an application. Your income for “VA Purposes” is your gross income less your unreimbursed medical expenses.

The VA has instituted a 36-month look back period for assets. This means that if you have given away any assets in the 36 months prior to applying for VA benefits, you may incur a penalty period or be disqualified for VA benefits. Consulting with a Certified Elder Law Attorney can help you determine the best way to qualify given your circumstances, and the quicker you act, the more options you will have.

Click here to contact us regarding Veteran’s Benefits. We will look at your specific situation and find ways that we may be able to help!

In 2024, the spouse of a veteran who requires care is eligible for a maximum of $1,806 per month.

A single veteran can have no more that $155,356 in total assets as of January 1, 2024. This amount includes retirement assets but excludes a home and a vehicle.

There is NO specified income limit for VA pension benefits. The VA has it’s own definition of income which they utilize in examining an application. Your income for “VA Purposes” is your gross income less your unreimbursed medical expenses.

The VA has instituted a 36-month look back period for assets. This means that if you have given away any assets in the 36 months prior to applying for VA benefits, you may incur a penalty period or be disqualified for VA benefits. Consulting with a Certified Elder Law Attorney can help you determine the best way to qualify given your circumstances, and the quicker you act, the more options you will have.

Click here to contact us regarding Veteran’s Benefits. We will look at your specific situation and find ways that we may be able to help!

Contact us regarding Veteran's Aid and Attendance

Contact us now and someone in our office will respond the following business day.

A Deeper Dive on the Aid and Attendance Benefit

VA Aid and Attendance is a “special monthly pension” available to wartime veterans or surviving spouses of wartime veterans.

Aid and Attendance is not a stand-alone benefit, but is awarded on top of either the “service” benefit or the “housebound” benefit. The veteran or surviving spouse must first be eligible for the “service” benefit. That requires the basic qualification by the veteran of having served at least 90 days of active military duty, at least one of those days had to be during wartime (as defined by the Veteran’s Administration).

Click here for the listing of wartimes, and having received a discharge that was other than dishonorable. Most veterans, of course, received honorable discharges.

Additionally, there are many people who served in capacities that were not specifically in the Army, Navy or Air Force who are included when considering VA benefits.

Click here for a list of qualifying services. Next the veteran or surviving spouse must have a permanent and total disability or be over 65. Amazingly enough, the VA rates all veterans over the age of 65 as “permanently and totally” disabled.

For veterans under the age of 65, permanent and total disability includes: a veteran who is in a nursing home; rated as disabled by the Social Security Administration; unemployable and reasonably certain to continue so throughout life; or suffering from a disability that makes it impossible for the average person to stay gainfully employed.

Once these initial hurdles have been cleared, the veteran or surviving spouse may additionally be entitled to, the additional Aid and Attendance pension. Please remember that Aid and Attendance is a level of pension and there is no requirement of a service-connected disability.

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind