Loved ones of all ages with special needs often have increased financial and care needs. Ensuring their long-term welfare presents unique challenges for disabled persons and proper estate planning is especially important. A Special Needs Trust also known as a Supplemental Needs Trust (SNT) can help to provide the necessary financial support needed without jeopardizing the individual's governmental benefits. SNTs can be a way to preserve assets to pay for the things that are not are not covered by public benefits throughout the disabled person’s lifetime. In other words, the SNT assets are used to make the disabled individual’s life as good as it can possibly be under the circumstances.

Why is a Special Needs Trust Necessary?

Gifts, bequests, inheritances, and death benefits to a disabled person may terminate their public benefits, like SSI and Medicaid. These programs are means-tested public assistance programs, and therefore, they impose strict asset and income limitations on the recipient. Additionally, those who receive SSI in Georgia automatically receive Medicaid. A Special Needs Trust can help to fund the needs of the disabled person, manage resources for that individual’s benefit, and protect and preserve eligibility for public benefits programs.

What does it mean to be disabled?

The Social Security Administration considers those that are (1) blind or (2) those that are unable to do any “substantial gainful activity” due to severe physical or mental impairments that will result in death or will continue for not less than one year to be disabled. However, this disability determination is not automatic. Some common disabilities include autism, cerebral palsy, Down syndrome and traumatic brain injury.

Often times families want to be able to leave gifts, inheritances and the like to their disabled loved one. However, it must be managed correctly. There are different types of trusts and funding a trust must be done according to the rules. Hurley Elder Care Law’s experienced attorneys will figure out the right trust for your situation and will work with you through the steps of funding the trust.

What are the different types of Special Needs Trusts?

Third party special needs trusts:

Often these are the most effective vehicles to utilize when transferring assets to a disabled person. They are typically established by parents and grandparents and must possess specific characteristics including:

- Created and funded by a third party

- Independent trustee must administer the trust according to the trust’s provisions

- Trust should have spendthrift provisions to protect the trust’s income and assets

First party self-settled Trusts:

Often are effective when a disabled individual has assets in their own name. You may have heard them referred to as a (d)(4)(A) Medicaid Payback Trusts or a (d)(4)(C) Pooled trusts. They have similar attributes to third party SNTs but some key differences include:

- upon the death of the disabled individual any Medicaid benefits received must first be reimbursed prior to any assets being distributed to remainder beneficiaries

- Pooled trusts are often ideal vehicles when locating an independent trustee is difficult or the asset size is small

Who is the client for Special Needs Planning purposes?

If a parent of a child with a disability is creating a third-party SNT for their disabled child, the parents are the client. If the adult with the disability is creating their own self-settled special needs trust, the disabled person is the client.

Proper Special Needs Trust planning can help to maximize public benefits while allowing family to provide support and care for their disabled loved one.

Proper Special Needs Trust planning can help to maximize public benefits while allowing family to provide support and care for their disabled loved one.

Contact us at 404-843-0121 to discuss your situation or click the button below

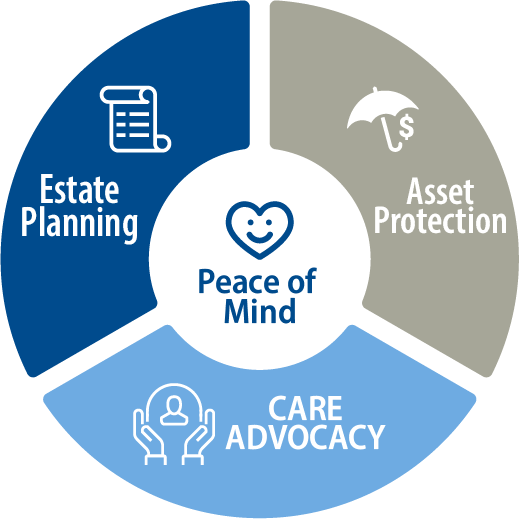

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind