So what documents do you need in place?

Contemplating losing capacity on a permanent or temporary basis is rarely top of mind. But the possibility of an unexpected accident or diagnosis is real. The Certified Elder Law attorneys at Hurley Elder Care Law can prepare these critical documents and execute them in our offices, your home and if necessary a hospital or nursing home setting.

A General Durable Power of Attorney for Financial Matters is important if you earn any income or own any property. Completing this document will allow someone you trust to step in and act on your behalf should you become unable. Having a GDPOA in place will allow the practical tasks of day-to-day life to be managed: paying your bills, communicating with the insurance company and even fixing the roof!

Completing a Georgia Advance Directive for Healthcare is critical for anyone over age 18. This document allows you to appoint a person you trust to make healthcare decisions for you should you become unable. It also provides options for more detailed advance care planning such as resuscitation, feeding tubes and antibiotics.

A will is a legal document that gives instructions on how to handle your property after you die. It acts as a guide so your estate (real property, bank accounts, investments and your “stuff”) can be distributed according to your wishes. The Certified Elder Law Attorney’s (CELA) at Hurley Elder Care Law will work with you to draft a will specific to your needs that appoints an executor who will carry out the instructions specified in your will.

Trusts are not just estate planning tools for the wealthy! In fact over the last few decades, people across all income brackets have used trusts to plan their estates and to avoid the costs and delays of probate. A trust is a separate legal entity that controls the assets you place into it. Determining if a trust is the right tool for you is an important part of designing an overall estate plan. The Certified Elder Law Attorney’s at Hurley Elder Care Law can review your family’s situation and recommend a plan that will minimize many of the bureaucratic headaches for your survivors, ease the potential conflict among family members and maximize the assets that can be distributed to your heirs.

Estate Planning Basics

When you hear the phrase “estate planning,” the first thought that comes to mind may be taxes. But estate planning is about more than just reducing taxes. It’s about ensuring your assets are distributed according to your wishes. The current estate tax exemption equivalent is $11,700,000 per person. Though this exemption is set to lapse at the end of 2025. We also never know what action Congress may take to change this law. But currently, very few people are affected by the Federal estate tax.

Fundamental Questions

Because estate planning is not just about reducing taxes but also about making sure your assets are distributed as you wish both now and after you’re gone, you need to consider some questions before you begin your estate planning.

Will or Living Trust?

You have two basic choices for transferring your assets on your death: the will, which is the standard method, and the living trust, which is rapidly growing in popularity. If you die without either a will or a living trust, state law controls the disposition of your property. And settling your estate likely will be more troublesome — and more costly.

The primary difference between a will and a living trust is that assets placed in your living trust can avoid probate at your death. Whether a will or a living trust is better for you depends on many personal factors. Let’s take a closer look at each vehicle.

If you choose just a will, your estate will have to go through probate. Probate is a court-supervised process to protect the rights of creditors and beneficiaries and to ensure the orderly and timely transfer of assets. The probate process has seven steps:

- Filing of the Probate petition and Will in the appropriate County Probate Court.

- Notification of interested parties. Most states require disclosure of the estate’s approximate value as well as the names and addresses of interested parties. These include all beneficiaries named in the will, natural heirs and creditors.

- Appointment of an executor. If you haven’t named an executor, the court will appoint one to oversee the estate’s liquidation and distribution.

Selecting an executor and the role of personal representatives - Accumulation of assets. Essentially, all assets you owned or controlled at the time of your death need to be accounted for.

- Payment of claims. The type and length of notice required to establish a deadline for creditors to file their claims vary by state. If a creditor does not file its claim on time, the claim generally is barred.

- Filing of tax returns. This includes final income and estate taxes.

- Distribution of residuary estate. After the estate has paid debts and taxes, the executor can distribute the remaining assets to the beneficiaries and close the estate.

Because probate is time-consuming, potentially expensive and public, avoiding probate is a common estate planning goal. A living trust (also referred to as a revocable trust, declaration of trust or inter vivos trust) acts as a will substitute, providing instructions for the management of your assets on your death and, if funded, during your life. You will still also need to have a short will, often referred to as a “pour over” will.

How does a living trust work?

You transfer assets into a trust for your own benefit during your lifetime. You can serve as trustee or select a professional trustee.

Selecting an executor and the role of personal representatives

You completely avoid probate only if all of your assets are in the living trust when you die, or your assets are held in a manner that allows them to pass automatically by operation of law (for example, a joint bank account). The pour over will can specify how assets you didn’t transfer to your living trust during your life will be transferred at death. Probate may still be necessary in order to cut off creditors’ claims.

Essentially, you retain the same control you had before you established the trust. Whether or not you serve as trustee, you retain the right to revoke the trust and appoint and remove trustees. If you name a professional trustee to manage trust assets, you can require the trustee to consult with you before buying or selling assets. The trust does not need to file an income tax return until after you die. Instead, you pay the tax on any income the trust earns as if you had never created the trust.

A living trust offers additional benefits.

First, unlike probate, your assets are not exposed to public record. Besides keeping your affairs private, this makes it more difficult for anyone to challenge the disposition of your estate. Second, a living trust can serve as a vehicle for managing your financial assets if you become mentally incapacitated or disabled. A properly drawn living trust avoids embarrassing conservatorship proceedings and related costs, and it offers greater protection and control than a durable power of attorney because the trustee can manage trust assets for your benefit.

Who should draw up your will or living trust?

A lawyer! Don’t try to do it yourself. Estate law is much too complicated. You should seek competent legal advice before finalizing your estate plan. While you may want to use your financial advisor to formulate your estate plan, wills and trusts are legal documents. Only an attorney who specializes in estate matters should draft them.

Personal Representatives, Trustees and Guardians

Selecting an executor or trustee

Whether you choose a will or a living trust, you also need to select someone to administer the disposition of your estate — an executor or personal representative and, if you have a living trust, a trustee. An individual, such as a family member, a friend or a professional advisor, or an institution, such as a bank or trust company, can serve in these capacities. (See Planning tip 3.) Many people name both an individual and an institution to leverage their collective expertise.

What does the executor or personal representative do? He or she serves after your death and has several major responsibilities, including:

- Administering your estate and distributing the assets to your beneficiaries,

- Making certain tax decisions,

- Paying any estate debts or expenses,

- Ensuring all life insurance and retirement plan benefits are received, and

- Filing the necessary tax returns and paying the appropriate federal and state taxes.

Whatever your choice, make sure the executor, personal representative or trustee is willing to serve. Also consider paying a reasonable fee for the services. The job isn’t easy, and not everyone will want or accept the responsibility. Provide for an alternate in case your first choice is unable or unwilling to perform. Naming a spouse, child or other relative to act as executor is common, and he or she certainly can hire any professional assistance needed.

Finally, make sure the executor, personal representative or trustee doesn’t have a conflict of interest. For example, think twice about choosing an individual who owns part of your business, a second spouse or children from a prior marriage. A co-owner’s personal goals regarding the business may differ from those of your family, and the desires of a stepparent and stepchildren may conflict.

Selecting a guardian for your children

If you have minor children, perhaps the most important element of your estate plan doesn’t involve your assets. Rather, it involves who will be your children’s guardian. Of course, the well-being of your children is your priority, but there are some financial issues to consider:

- Will the guardian be capable of managing your children’s assets?

- Will the guardian be financially strong? If not, consider compensation.

- Will the guardian’s home accommodate your children?

- How will the guardian determine your children’s living costs?

If you prefer, you can name separate guardians for your child and his or her assets. Taking the time to name a guardian or guardians now ensures your children will be cared for as you wish if you die while they are still minors.

Contact us regarding these decisions. We will analyze your specific situation and provide guidance in these matters.

Planning Tips

Title Assets Properly

Only assets titled in your living trust’s name avoid probate. When you create the trust, make sure you direct your legal advisor to change the title of all assets you want managed by your trust’s provisions.

Professional vs. Individual Executor or Trustee

The advantages of a professional executor or trustee include being a specialist in handling estates or trusts, no emotional bias, impartiality, independence (sensitive to but not hindered by emotional considerations), and financial expertise.

Let us help you get your paperwork in order

Contact us now and someone in our office will respond the following business day.

From the blog

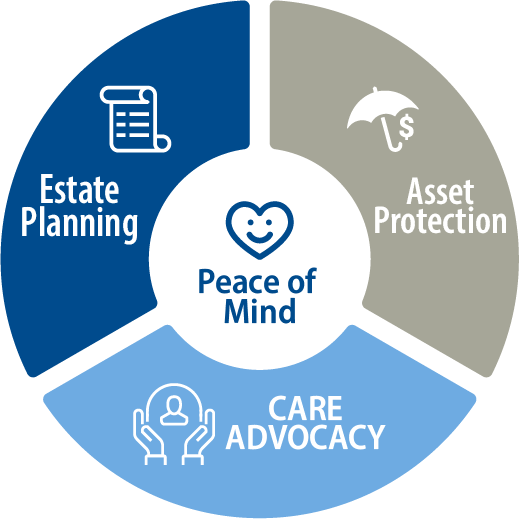

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind

Dying Without a Will can Cause Big Problems

Dying without a Will can cause your family unnecessary stress and grief. Learn how Georgia decides how your estate is distributed if you die without a Will

Frequently Asked Questions

There is no better peace of mind than the security of knowing you have made the best possible decisions for the care and safety of yourself and your family.

Contact us at 404-843-0121 for a complimentary telephone consultation, or submit your question below.

We’ll respond to your inquiry on the next business day. You can also email us at info@hurleyeclaw.com