When an individual has income and assets that exceed the Medicaid threshold there are options available to avoid a spend down or a Medicaid denial. A Certified Elder Law Attorney can help you implement a plan that allows an individual to qualify for Georgia Nursing Home Medicaid, and preserving a substantial portion of their assets.

Income and Asset Requirements

Case Study

If one spouse needs Medicaid for a skilled nursing facility, families are afraid that the assets they have accumulated over a lifetime will quickly be depleted due to the high cost of care. Working with a Certified Elder Law Attorney at HECL, a spouse can confidently preserve all of their hard-earned savings while still receiving the Medicaid benefit for the spouse who needs long-term care.

Income and Asset Requirements – Good News for Married Couples

If your spouse is in a nursing home, Medicaid does NOT consider your income in determining eligibility. Even if your income is $1000 a month or even $10,000 per month – it doesn’t matter! In fact, if your income is below $3,853.50 you can receive some of your unwell spouse’s income too!

I’ve got more good news, you can keep $148,620 of your assets. If you have assets above and beyond that, Hurley Elder Care Law can devise a plan to save all of your hard-earned savings. Click here for a discussion on countable and exempt assets as well as income diversion. In Georgia, the community spouse is allowed to keep all countable assets up to $154,140 (as of 2024). This is called the Community Spouse Resource Allowance (CSRA). Each state also establishes a monthly income floor for the at‐home spouse. This is called the Community Spouse Maintenance Needs Standard (CSMNS). This permits the community spouse to keep a minimum monthly income of up to $3,853.50 (as of 2024).

Case Study | Medicaid Planning for Married People

Ralph and Alice were high school sweethearts who lived in Marietta their entire adult lives. Two weeks ago Ralph and Alice celebrated their 51st anniversary. Yesterday Ralph, who has Alzheimer’s disease, wandered away from home. Hours later he was found sitting on a street curb, talking incoherently. He was taken to a hospital where he is being treated for dehydration. The family doctor tells Alice she needs to place Ralph in a nursing home. They both grew up during the Depression and have always tried to save something each month. Their assets, totaling $182,000 not including their house, are as follows:

- Savings Account $30,000

- CDs $90,000 Money

- Market Account $50,000

- Checking Account $12,000

- Residence (no mortgage) $80,000

Ralph gets Social Security and pension checks totaling $1500 each month; Alice’s Social Security check is $450. If Alice and Ralph have to pay the private pay rate to the nursing home, their entire life savings will be gone in less than two years! What’s more, Alice is afraid she won’t be able to pay her monthly bills, because a neighbor told her that the nursing home will be entitled to all of Ralph’s Social Security and pension checks.

There is good news for Alice. It’s possible she will get to keep her income, most of his income and most of their assets and still have the state Medicaid program pay Ralph’s nursing home costs. While the process may take a little while, the end result will be worth it.

To apply for Medicaid, she will have to go through the Georgia Department of Family and Children Services (DFCS). If she does things strictly according to the way DFCS tells her, she will only be able to keep her home and $154,140 of their assets plus she will be entitled to a minimum monthly income to pay her expenses.

But the results can actually be much better than the traditional spend‐down, which everyone talks about. Alice might be able to turn the spend‐down amount of roughly $60,000 into an income stream that will increase her income and meet the Medicaid spend‐down right away. In other words, if handled properly, Ralph might be eligible for Medicaid from the first month he goes into the nursing home.

Please note that this will not work in every case. That is why it is important to have an elder law attorney guide you through the system and the Medicaid process to find the strategies that will be most beneficial in your situation.

Alice will have to get advice from someone who knows how to navigate the system, but with proper advice she may be able to keep most of what she and Ralph have worked so hard for. This is possible because the law does not intend to impoverish one spouse because the other spouse needs care in a nursing home. This is certainly an example where knowledge of the rules and how to apply them can be used to resolve Ralph and Alice’s dilemma.

Of course, proper Medicaid planning differs according to the relevant facts and circumstances of each situation as well as the state law.

Atlanta’s Top 10 Medicaid Myths

Medicaid has truly become the long-term care insurance of the middle class. As we live longer and as care costs continue to rise, more and more families will look to Medicaid to pay the cost of Nursing Home care. Consult a Certified Elder Law Attorney (CELA) to determine if Medicaid qualification is an option for your loved one.

Have questions about how Medicaid could work for you?

Contact us now and someone in our office will respond the following business day.

From the blog

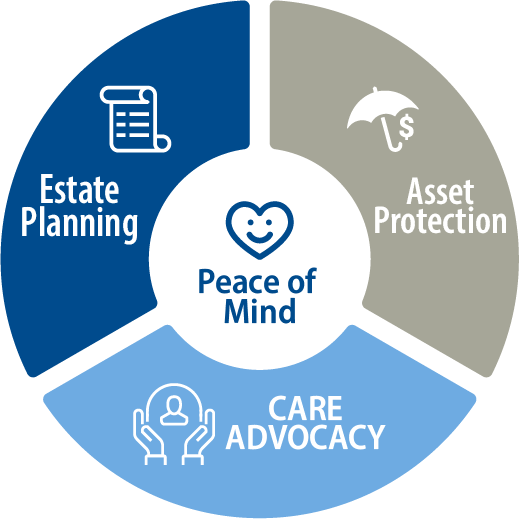

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind

Medicaid FAQs

Medicaid Denials

Receiving a denial after enduring the long and tedious Medicaid Application process can be scary and frustrating. Depending on the situation, there are many different strategies for overturning an initial denial. Our attorneys will review your specific situation and can not only assist with handling the appeal but may also be able to protect your original application date. Timing is of the essence in this situation so don’t delay. Contact us so that we can review your specific situation and find ways we can help! When dealing with a Medicaid denial knowledge is power.