Oops

The page you are looking for does not exist. It may have been moved, or removed altogether.

Try searching our site to see if you can find what you are looking for.

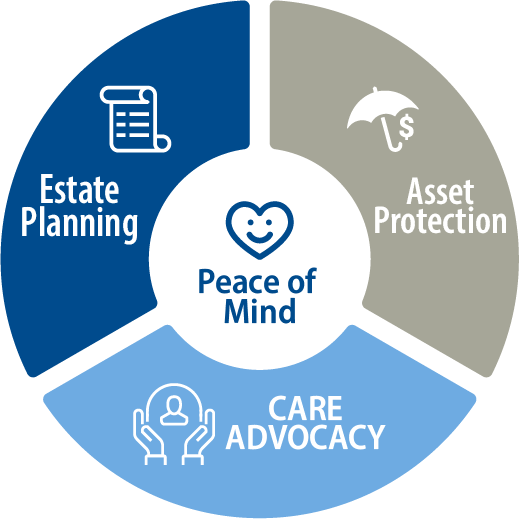

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind