Asset preservation isn’t just for the wealthy

Many people have the misconception that in order to engage in asset protection, they must have significant wealth. While some families are seeking to preserve their assets for their children and grandchildren, many seniors want to protect their home and savings from catastrophic nursing home costs. All seniors should be concerned about the protection and preservation of their assets because the statistics indicate that most people over age 65 will likely use institutional care, such as a nursing home, at some point in their lives.

Planning now saves time and money later

As a loved one ages, it’s important to design a strategy for using their income and assets in the most effective manner. Working with a Certified Elder Law Attorney (CELA) to implement a plan for asset preservation will allow them to receive the best quality care regardless of the setting, allow for financial independence of a well spouse and increase the potential of leaving an inheritance.

Avoid catastrophic nursing home costs

Medicaid asset protection involves preparing a thorough plan. You can transfer your assets to close family members or to an irrevocable trust in order to lessen the amounts available and thereby qualify for Medicaid benefits. Transfers that occur within five (5) years of nursing home admission will create a period of ineligibility for Medicaid. Is you loved one entering the nursing home now?

CLICK HERE FOR INFORMATION ON OBTAINING MEDICAID ELIGIBILITY.

Quality Planning Requires a Professional

Tax considerations also play a key role in Medicaid asset protection. Tax consequences for income, capital gains and gift tax must be considered. A Medicaid plan is generally designed to be tax neutral. But, failure to plan properly can result in additional taxes being owed.

Asset Preservation – Revocable Living Trusts

It is ideal to work with an experienced attorney who is adept at rearranging your assets to help you become eligible for Medicaid. Proper planning can guarantee security for your significant assets at any time, even after a family member has entered a nursing home.

Can an asset protection strategy help you manage the cost of long-term care?

Contact us at 404-843-0121 to discuss your situation or click the button below.

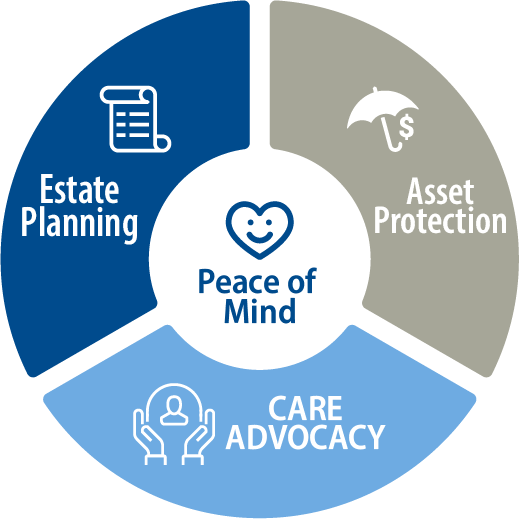

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind