How Can an Elder Law Attorney Help Me?

Certified. Compassionate. Competent. Experienced.

Aging comes with a series of complex challenges and decisions around money, care and access to benefits.

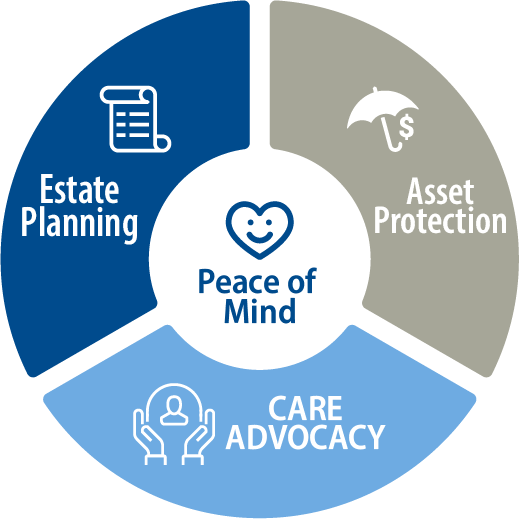

We provide a holistic approach to planning for the inevitable challenges of aging so that you get the care you or your loved one needs, while simultaneously protecting your assets, and respecting individual autonomy as well as physical, intellectual, social, and spiritual needs.

Unlike any other elder care practice, we employ a multi-disciplinary team combining expert legal advice and care coordination (nursing and social workers) to help you get the resources, benefits, care, and asset protection that you need so that you can have peace of mind, knowing all your decisions are the right ones.

There is no better peace of mind than the security of knowing you have made the best possible decisions for the care and safety of yourself and your family.

From the blog

Featured Resources

Life Care Planning Model

Meet the inevitable challenges of your family's current and future needs

Appropriate Care

Asset Protection Solutions

Peace of Mind

There is no better peace of mind than the security of knowing you have made the best possible decisions for the care and safety of yourself and your family.

Contact us at 404-843-0121 for a complimentary telephone consultation, or submit your question below.

We’ll respond to your inquiry on the next business day. You can also email us at info@hurleyeclaw.com